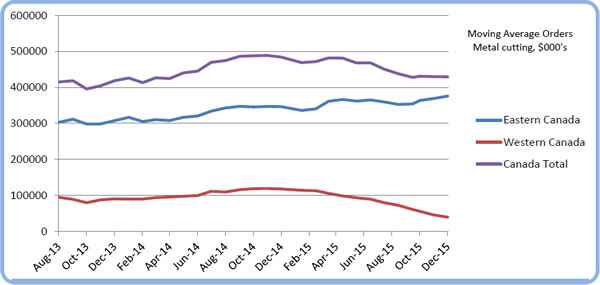

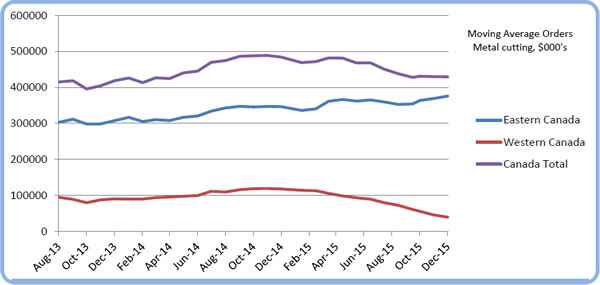

Orders for metal cutting machinery for the year ending December 2015 were down by 10% year over

year but by considerably more when you take into the account the price inflation caused by the declining

value of the Canadian Dollar which has dropped 17.5% over the same time span. The major contributing

factor has been the dramatic drop in orders from Western Canada due to the declining value of oil.

Eastern Canada saw an increase in orders of 8.4% while Western Canada had a precipitous drop of 66.5%

year over year. The chart below shows the moving average of orders for east and west and the two

combined.

Orders for fabricating machinery held up well in comparison with orders for CNC machines up by 19% in spite of a

drop in units of 5%. Orders for manual machines were up by 7% in both units and values

Average order size for CNC metal cutting machinery YTD were as follows: horizontal lathes, $191,017, vertical

spindle lathes, $206,692, multitasking lathes, $353,976, VMC up to 40” travel, $158,673, VMC above 40” travel,

$262,613, VMC five or more axis, $586,023, horizontal machining centers, $401,564, horizontal machining centers

5axis, $1,529,208, milling machines , $20,135, horizontal and vertical boring machines, $680,448, wire EDM,

$227,510, sinker EDM, $256,625, grinders, $340,611, CMM, $151,189, saws, $57,333, others, $246,500. Average

order size for manual metal cutting machines was $19,613.

Average order size for CNC fabricating machinery were: press brakes, $167,312, shears, $49,854, turret punches,

$497,292, profile cutting laser, $722,054, profile cutting plasma, $189,714, profile cutting water jet, $144,718, tube

benders, $67,647, others, $160,000.

Average order size for manual fabricating machinery was $12,684 and for presses and equipment was $34,625.

|

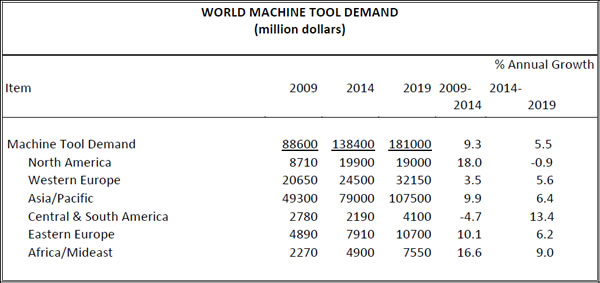

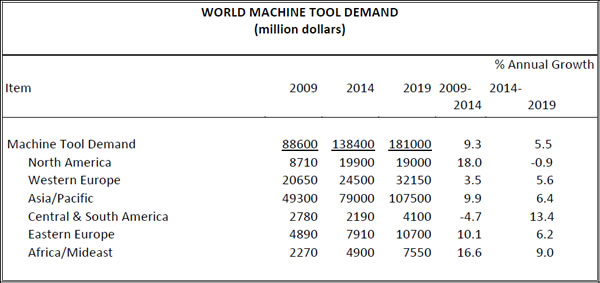

Worldwide demand for machine tools is projected to climb 5.5 percent per year through 2019 to $181 billion.

Gains at the global level will be largely driven by market growth in China and other developing nations, where demand

for durable goods is expected to post the strongest increases. This will result in additional investment in new

manufacturing capacity and related machine tools in the Asia/Pacific region, the Africa/Mideast region, Eastern

Europe, and Central and South America. China alone is expected to account for more than two-fifths of all new

product demand through 2019. These and other trends are presented in World Machine Tools, a new study from

Freedonia Group, a Cleveland-based industry research firm.

Through 2019, machine tool demand in Western Europe, the second largest regional market worldwide, is

expected to grow nearly six percent per annum. Growth will be in line with the average worldwide pace, and

Western Europe will account for 18 percent of product demand gains through 2019. Market conditions in numerous

regional countries are expected to improve as both overall economic growth and gross fixed investment accelerate.

Analyst Gleb Mytko notes, “Growth will also be supported by the introduction of more expensive machine tools.” In

order to develop the next generation of durable goods, manufacturers in the region will invest in machine tools that

offer increased control and precision. In Japan, the world’s fourth largest national market behind China, the US, and

Germany, demand for machine tools is expected to rebound after several years of losses. Because many Japanese

durable goods firms delayed making machine tool purchases in recent years, there is significant pent-up demand in

the country.

North America is projected to see machine tool demand decline nearly one percent per year through 2019, due

solely to weakness in the large US market result. In contrast, Mexico will continue to experience rapid advances in machine advances in machine tool sales, while the

Canadian market is expected to grow at about the world average pace. Many durable goods companies in North

America modernized existing facilities, built new plants, and purchased additional machine tools in recent years. As

a result, there will be less new and replacement product demand in the region during the 2014-2019 period.

© 2016 by The Freedonia Group, Inc.

World Machine Tools (published 01/2016, 447 pages) is available for $6300 from Freedonia Group. For

further details or to arrange an interview with the analyst, please contact Corinne Gangloff by phone

440.684.9600 or e-mail pr@freedoniagroup.com. Information may also be obtained through

www.freedoniagroup.com.

|

| The CMTDA's Purpose and Objectives |

>The Canadian Machine Tool Distributors Association was founded in 1942 as a trade association dedicated to the marketing of machine tools and services in Canada through distributorship companies.

Its aims are: |

- To promote friendly business relations among its members.

- To provide means whereby challenges affecting the industry can be readily discussed and to co-operate, as a group, to further the interests of the industry by all desirable and lawful means.

- To stimulate growth in the use of machine tools

- To promote advances in machine tool technologies

- To assist clients in finding distributors to supply machine tools

- To collect and disseminate statistics on market capacity and other pertinent matters.

- To exchange information among members for the purpose of reducing distribution costs and eliminating waste and duplication of efforts.

- To enable the members, as a group, to discuss with the government, if need be, tariff concerns and other issues relating to machine tools.

- To promote and sponsor machining skills development for youth Canada-wide.

|

|

CMTDA Annual General Meeting

October 26th 2016

Please mark your calendar for this important

event. You can be assured we will have some

entertaining speakers along with the President’s

Cocktail Reception followed by dinner.

Plans are underway for the CMTDA’s 75th

anniversary celebration in 2017, details to be

announced |

|

|

| |

| CMTDA

Board of Directors |

|

| President |

| |

Tejal Mehta, Emec Machine Tools Inc. |

|

| Past President |

| |

Frank Haydar, Elliott Matsuura Canada Inc |

|

| Director |

| |

Ray Buxton, Mazak Canada Inc |

|

| Director |

| |

Daniel Medrea, DMG/Mori Seiki |

|

| Director |

| |

John Manley, Machine Tools Systems Inc |

|

| Director |

| |

Jeff Veldhoen, Ferro Technique |

|

| Director |

| |

Stefan Fickenscher, Trumpf Canada Inc |

| Director |

| |

Gary Masters, William Brennan |

|

| Executive Director |

| |

Peter Turton |

|

|

| How To Join |

Any individual, partnership, firm, company or corporation may

be elected to membership in the CMTDA by an affirmative vote

of not less than 2/3 majority of the current directors of the

Corporation. A regular member is one which maintains an office

or other recognized place of business, represents at least one

recognized manufacturer of machine tools on an exclusive basis

in a designated territory, carries its own accounts, is established

and actively engaged in the distribution of machine tools in

Canada for at least one year at the time of application, does at

least 51% of its business in new machinery and provides monthlyorders booked data in the format set out by the Corporation |

Contact the CMTDA at:

118 Landry Lane, PO Box 951

Thornbury, ON. N0H 2P0.

Phone 519-599-2803,

fax 519-599-5154. |

|

|

C.M.T.D.A.

MEMBERS |

A.M.T. Machine Tools Ltd.

A.W. Miller Technical Sales

Canada

Akhurst Machinery Ltd.

All Fabrication Machinery Ltd.

Amada Canada

Barer Engineering Co.

Blue Chip Leasing

BLUM LMT Inc.

Buy Premium Tools

B W Guild Equipment Inc

Canadian Industrial

Machinery, CIP

Canadian Measurement-

Metrology Inc.

Canadian Metalworking

Capital North Corporation

CLE Leasing Enterprise Ltd.

CML Machinery Inc.

Compumachine Canada

DiPaolo Machine Tools

DMG Mori Seiki Canada

Edge Production Supplies Ltd.

Elliott Matsuura (Canada) Inc.

EMEC Machine Tools Inc.

Empire Machinery & Tools Ltd.

Fagor Automation Canada

Ferric Machinery

Ferro Technique Ltd.

Garant Machinerie

Hartford Technology Ltd.

Heinman Machinery Ltd

Hurco Companies

Huron Canada Inc.

Ian Jones Sales Ltd.

Industrial Machinery

Exchange Inc.

Iscar Tools Inc.

ITN Logistics Group

KBC Tools and Machinery

Kennametal Ltd, Canada

LaMarche Machinery Inc.

L.S. Walker Machine Tools Inc.

Machine Tool Systems Inc.

Machine Toolworks Inc. |

Machineries BV Ltee.

Machitech Automation

Masteel America Corp

Mazak Corp. Canada

MC Machinery Canada

Megatel Inc.

Mitcham Machine Tools

Mitutoyo Canada Inc.

MP&P Magazine

National leasing Group

Neiman Machinery Sales

Inc.

NTN Bearings Canada

Paine Machine Tool Inc.

Paramount Machinery Inc.

Powermaster Machinery

Prima-Power Canada

Quality Cutting Tools

Quickmill Inc.

Renishaw (Canada) Ltd.

Rhino Cutting Systems

Royal Products

Sandvik Coromant

Schunk Intec Corporation

Seguin Machinery Ltd.

Shop Metalworking

Magazine

Synergy Machine Sales Inc

Single Source Technologies

Canada,

Sirco Machinery Co. Ltd.

SMS Machine Tools Ltd.

SMTCL Canada Inc.

Spark & Co. Inc.

SparQuetec Inc.

Team Machine Tools Inc.

Tecsaw International

Thomas Skinner & Son Ltd.

Toshiba Machine Co.

Canada Ltd.

TOS Trade Canada

Trumpf Canada

Ultra Machine Sales Ltd.

Westway Machinery Ltd.

William M. Brennan Co.

Zoller Inc. |

|

|

|

|

|

|

|

Canadian Machine Tool Distributors’ Association

www.cmtda.com

118 Landry Lane, PO Box 951

Thornbury, Ontario, N0H 2P0

(519) 599 2803, Fax (519) 599 5154

E mail info@cmtda.com |

|

|

Manufacturing in Canada has had many ups and downs within the last few years. Many factors and industry sectors have created a volatility in this country which has made forecasting/growth a challenge.

Manufacturing in Canada has had many ups and downs within the last few years. Many factors and industry sectors have created a volatility in this country which has made forecasting/growth a challenge.

Back Row (L-R):

Back Row (L-R):