|

President’s Message.

More than five years into the” Canadian recovery” most of us expected healthy growth – while the pessimists between us are already looking for signs of the next recession. But in the aftermath of the last financial crisis, the pace of recovery is much slower than forecasted at the beginning of the year. The uncertainty that continues in Europe, in the emerging economies and even within the United States, have combined to produce an economic environment in which demand for Canadian exports are sub-par. That is why the collective wisdom of economists and financial strategists can be summarized to a few words:

“Until there is a healthy and sustained recovery in the global economy, Canadian investments and exports will continue to disappoint.”

The Bank of Canada latest reports confirm a sluggish economy – economic growth of only 1.2% annualized for the first half of 2014. This disappointing economic performance will most likely compel the Bank of Canada to keep its present benchmark interest rate at 1% (at least for the second half of 2014).

In such uneasy circumstances the Gardner Business Media Report: “2014 World Machine Tool Output and Consumption Survey” has forecasted that the overall worldwide machine tool consumption will grow 6.2% in 2014 (over 2013) – to a total value of US$58,3B.

Consumption (C) of machine tools of a certain country (or world area) is calculated by adding imports (I) to production (P) and subtracting exports (E): C=I+P-E.

The Gardner’s Survey forecasts consumption growth by world region as follows:

North America: 8.3%.

Europe: 7.2%.

Asia: 4.1%.

South America: 2.8%.

The 25 top consuming and producing countries of machine tools account for roughly 95% of all consumption and production. The first five “biggies” (largest consuming machine tools countries in 2014) are forecasted as follows:

China: stationary at $11.4B.

USA: growth of 15% to $9.3B.

Germany: growth of 12% to $7.9B.

South Korea: growth of 13% to $5.1B.

Japan: growth of 6% to $4.5B.

The 2014 Gardner forecast was created using the three most important leading indicators of machine tools consumption: money supply, capacity utilization and manufacturing production. Interesting to note that PRODUCTION of machine tools is always higher than CONSUMPTION – the difference is the amount of INVENTORY held by machine tool builders and their distributors.

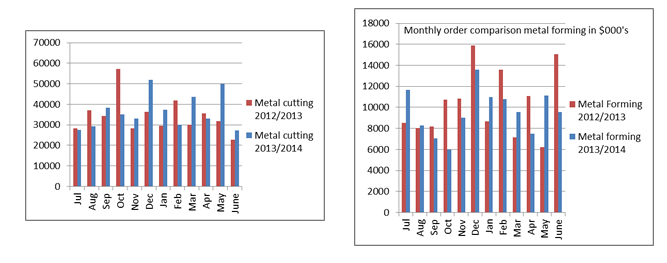

And how did Canada perform at the half year mark of 2014, compared with same period of 2013?

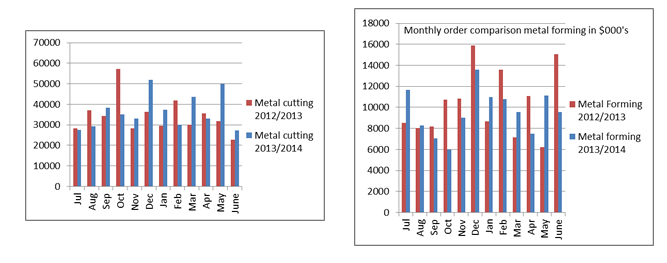

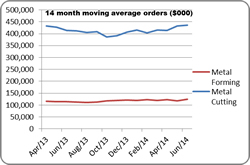

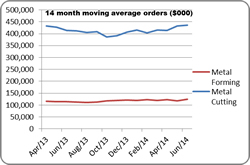

As per CMTDA data, machine tools orders as of June 30, 2014 were as follows:

- CNC Metal Cutting Machines: up 5% for units, up 14% for value.

- Non CNC Metal Cutting Machines: down 6% for units, up 13% for value.

- CNC Metal Forming Machines: up 3% for units, up 4% for value.

- Non CNC Metal Forming Machines: down 3% for units, same value.

- Stamping and Forming Presses: down 3% for units, up 3% for value.

As historically the second half of the year is always stronger than the first half, the projected forecast for the complete year of 2014 looks good for our industry.

In addition, the largest North American machine tool show, (IMTS), usually a harbinger of increased sales activity, is just around the corner: September 8 to 13, incl. (McCormick Place, Chicago, IL.).

|

|

Orders for metal cutting machine tools have increased by 14% in value by 5% in units when comparing June 2014 to June 2013. Orders for CNC metal cutting machines have shown dramatic increases in almost all machine types with the exception of 4 axis HMC’s which saw a 40% decline in sales and units. The greatest gains were seen in EDM wire , grinders and CMM’s. Non CNC machines showed declines in both values and units 9% and 18% respectively

Forming machinery orders have recovered somewhat and CNC machines showed a slight increase in units and values. Shears and press brakes had significant increases in units and values while laser cutting machines had increased value with a decrease in units. Manual machine orders and units remain largely unchanged.

Average order size for CNC metal cutting machinery YTD were as follows: horizontal lathes, $196,800, vertical spindle lathes, $225,000, multitasking lathes, $387,000 VMC up to 40” travel, $121,000, VMC above 40” travel, $220,000, VMC five or more axis, $593,000, horizontal machining centers, $416,000, horizontal machining centers 5axis, $1,590,000, milling machines , $43,000, horizontal and vertical boring machines, $748,000, wire EDM, $169,000, sinker EDM, $235,000, grinders, $268,000, CMM, $138,000, saws, $75,000, others, $244,000. Average order size for manual metal cutting machines was $17,500. Average order size for CNC metal cutting machinery YTD were as follows: horizontal lathes, $196,800, vertical spindle lathes, $225,000, multitasking lathes, $387,000 VMC up to 40” travel, $121,000, VMC above 40” travel, $220,000, VMC five or more axis, $593,000, horizontal machining centers, $416,000, horizontal machining centers 5axis, $1,590,000, milling machines , $43,000, horizontal and vertical boring machines, $748,000, wire EDM, $169,000, sinker EDM, $235,000, grinders, $268,000, CMM, $138,000, saws, $75,000, others, $244,000. Average order size for manual metal cutting machines was $17,500.

Average order size for CNC fabricating machinery were: press brakes, $136,000, shears, $47,000, turret punches, $475.000, profile cutting laser, $774,000, profile cutting plasma, $286,000, profile cutting water jet, $242,000, tube benders, $37,000, others, $182,000.

Average order size for manual fabricating machinery was $5,000 and for presses and equipment was $30,000

|

In Memorium:- Jim Burrows who passed away June 27th 2014 aged 79

Born in Agincourt Ontario in 1935 Jim worked as an apprentice tool and die maker at Emmonds Tool and Die in Scarborough, Ontario. From there he went to Williams and Wilson where he rose through the ranks to become Sales Manager. When Williams and Wilson closed it’s operations in Ontario, Jim went to work for SMS Machine Tools as Marketing Manager until his retirement in 1995. With machine tools in his blood Jim then took on the role of Executive Director of CMTDA , a position he held until he finally retired for good in 2008.

Jim and his wife of 57 years lived in Minden Ontario He was an avid golfer and curler and was active in the Masons.

For those of us who knew Jim, we can always remember his charm and ready smile, not to mention his endless supply of jokes and sense of humour. He was well respected in his professional life as well as his private life which was evidenced by the packed church for his celebration of life service in July 2014 |

SPRING MEETING 2014

The spring meeting which took place again at the Sightlines restaurant in the Rogers Centre in June was a great success with 115 CMTDA members, spouses, friends and family in attendance. The buffet dinner was excellent and that along with an open bar made for a memorable evening.

This was the second time we have had the Spring Meeting at the Rogers Centre and it proved to be a great success again. The outcome of the game was not as great as last year as the Jays were beaten by the Yankees, even so it was an exciting game and the evening was enjoyed by all those who attended. If anyone has a suggestion for next year’s event please let us know by e mail at info@cmtda.com |

|

CMTDA Directory.

The 2015 edition of the CMTDA directory will be published in the Spring of 2015 and we would urge every member to review their listing in the 2014 edition and be prepared to make any changes when Canadian Metalworking approaches you in the fall for any updates.

You are reminded that it is your responsibility to make sure that your listing is correct. Do not rely on your listing on the CMTDA website being used to compile the data for the directory as CM uses their own data base without reference to the web site |

CMTDA Annual General Meeting

November 26th 2014

Please mark your calendar for this important event. Following the success of last year’s meeting with Scotty Bowman and Elliotte Freedman you can be assured that we will have some equally entertaining speakers for this years AGM |

| CMTDA

Board of Directors |

|

| President |

| |

Frank Haydar, Elliott Matsuura Canada Inc |

|

| Past President |

| |

John Manley, Machine Tools Systems Inc |

|

| Director |

| |

Ray Buxton, Mazak Canada Inc |

|

| Director |

| |

Robert Dunbar, DMG/Mori Seiki/Ellison |

|

| Director |

| |

Luke Kerr, Amada Canada |

|

| Director |

| |

Tejal Mehta, Emec Machine Tools Inc. |

|

| Director |

| |

Stefan Schreiber, Trumpf Canada Inc. |

|

| Executive Director |

| |

Peter Turton |

|

|

|

|

| The CMTDA's Purpose and Objectives |

>The Canadian Machine Tool Distributors Association was founded in 1942 as a trade association dedicated to the marketing of machine tools and services in Canada through distributorship companies.

Its aims are: |

- To promote friendly business relations among its members.

- To provide means whereby challenges affecting the industry can be readily discussed and to co-operate, as a group, to further the interests of the industry by all desirable and lawful means.

- To stimulate growth in the use of machine tools

- To promote advances in machine tool technologies

- To assist clients in finding distributors to supply machine tools

- To collect and disseminate statistics on market capacity and other pertinent matters.

- To exchange information among members for the purpose of reducing distribution costs and eliminating waste and duplication of efforts.

- To enable the members, as a group, to discuss with the government, if need be, tariff concerns and other issues relating to machine tools.

- To promote and sponsor machining skills development for youth Canada-wide.

|

|

| CMTDA

Board of Directors |

|

| President |

| |

Frank Haydar, Elliott Matsuura Canada Inc |

|

| Past President |

| |

John Manley, Machine Tools Systems Inc |

|

| Director |

| |

Ray Buxton, Mazak Canada Inc |

|

| Director |

| |

Robert Dunbar, DMG/Mori Seiki/Ellison |

|

| Director |

| |

Luke Kerr, Amada Canada |

|

| Director |

| |

Tejal Mehta, Emec Machine Tools Inc. |

|

| Director |

| |

Stefan Schreiber, Trumpf Canada Inc. |

|

| Executive Director |

| |

Peter Turton |

|

|

| How To Join |

Any individual, partnership, firm, company or corporation may

be elected to membership in the CMTDA by an affirmative vote

of not less than 2/3 majority of the current directors of the

Corporation. A regular member is one which maintains an office

or other recognized place of business, represents at least one

recognized manufacturer of machine tools on an exclusive basis

in a designated territory, carries its own accounts, is established

and actively engaged in the distribution of machine tools in

Canada for at least one year at the time of application, does at

least 51% of its business in new machinery and provides monthlyorders booked data in the format set out by the Corporation |

Contact the CMTDA at:

118 Landry Lane, PO Box 951

Thornbury, ON. N0H 2P0.

Phone 519-599-2803,

fax 519-599-5154. |

|

|

C.M.T.D.A.

MEMBERS |

A.M.T. Machine Tools Ltd.

A.W. Miller Technical Sales Canada

Akhurst Machinery Ltd.

All Fabrication Machinery Ltd.

Amada Canada

Barer Engineering Co.

BLUM LMT Inc.

Buy Premium Tools

B W Guild Equipment Inc

Canadian Industrial Machinery, CIP

Canadian Measurement-

Metrology Inc.

Canadian Metalworking

Capital North Corporation

CLE Leasing Enterprise Ltd.

CML Machinery Inc.

Compumachine Canada

DMG Mori Ellison

ECCO Machinery

Edge Production Supplies Ltd.

Elliott Matsuura (Canada) Inc.

EMEC Machine Tools Inc.

Empire Machinery & Tools Ltd.

Enable Capital Corporation

Fabricating Machinery Solutions

Fagor Automation Canada

Ferric Machinery

Ferro Technique Ltd.

Garant Machinerie

Hartford Technology Ltd.

Heinman Machinery Ltd

Hurco Companies

Huron Canada Inc.

Ian Jones Sales Ltd.

Industrial Machinery

Exchange Inc.

Iscar Tools Inc

ITN Logistics Group

Kennametal Ltd, Canada

LaMarche Machinery Inc.

L.S. Walker Machine Tools Inc. |

Machine Tool Systems Inc.

Machine Toolworks Inc.

Machineries BV Ltee.

Machitech Automation

Masteel America Corp

Mazak Corp. Canada

MC Machinery Canada

Megatel Inc.

Mitcham Machine Tools

Mitutoyo Canada Inc.

Montfort International

MP&P magazine

M&H Probing Systems

Neiman Machinery Sales Inc.

NTN Bearings Canada

Paine Machine Tool Inc.

Paramount Machinery Inc.

Powermaster Machinery

Prima-Power Canada

Quality Cutting Tools

Quickmill Inc.

Renishaw (Canada) Ltd.

Royal Products

Sandvik Coromant

Seguin Machinery Ltd.

Shop Metalworking

Synergy Machine Sales Inc

Technology Magazine

Single Source Technologies Canada,

Sirco Machinery Co. Ltd.

SMS Machine Tools Ltd.

SMTCL Canada Inc.

Spark & Co. Inc.

SparQuetec Inc.

Team Machine Tools Inc.

Tecsaw International

Thomas Skinner & Son Ltd.

Toshiba Machine Co.

Canada Ltd.

TOS Trade Canada

Trumpf Canada

Ultra Machine Sales Ltd.

Westway Machinery Ltd.

William M. Brennan Co.

Zoller Inc |

|

|

|

|

|

|

|

Canadian Machine Tool Distributors’ Association

www.cmtda.com

118 Landry Lane, PO Box 951

Thornbury, Ontario, N0H 2P0

(519) 599 2803, Fax (519) 599 5154

E mail info@cmtda.com |

|

|

Average order size for CNC metal cutting machinery YTD were as follows: horizontal lathes, $196,800, vertical spindle lathes, $225,000, multitasking lathes, $387,000 VMC up to 40” travel, $121,000, VMC above 40” travel, $220,000, VMC five or more axis, $593,000, horizontal machining centers, $416,000, horizontal machining centers 5axis, $1,590,000, milling machines , $43,000, horizontal and vertical boring machines, $748,000, wire EDM, $169,000, sinker EDM, $235,000, grinders, $268,000, CMM, $138,000, saws, $75,000, others, $244,000. Average order size for manual metal cutting machines was $17,500.

Average order size for CNC metal cutting machinery YTD were as follows: horizontal lathes, $196,800, vertical spindle lathes, $225,000, multitasking lathes, $387,000 VMC up to 40” travel, $121,000, VMC above 40” travel, $220,000, VMC five or more axis, $593,000, horizontal machining centers, $416,000, horizontal machining centers 5axis, $1,590,000, milling machines , $43,000, horizontal and vertical boring machines, $748,000, wire EDM, $169,000, sinker EDM, $235,000, grinders, $268,000, CMM, $138,000, saws, $75,000, others, $244,000. Average order size for manual metal cutting machines was $17,500.